The alcoholic beverage market is booming as liquor manufacturers release new products and revamp old ones in order to increase sales at home drinking. The particular focus of this survey was premium beer, which is seeing many new releases.

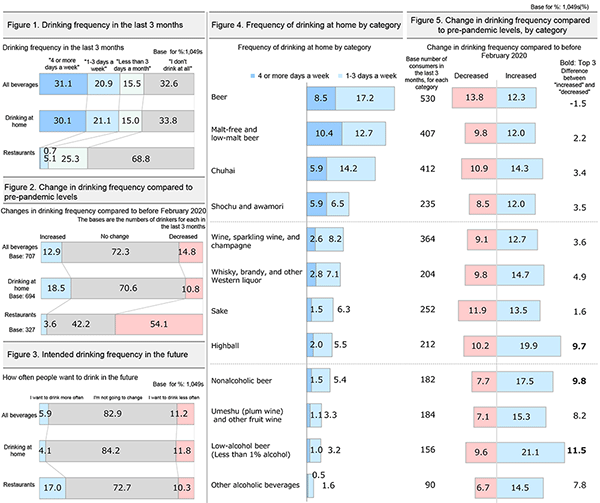

First, comparing the changes in people's frequency of drinking alcohol with February 2020--before the pandemic--for all alcoholic beverages, more said it had decreased than said it had increased, but more said they were drinking at home more often (Figure 2). On the other hand, consumption at restaurants had declined significantly. Regarding their intended drinking frequency in the future, more people responded that they would like to drink more at restaurants than those that said they would like to do so more at home (Figure 3). Drinking at restaurants is predicted to gradually become more frequent.

Next, we focused on drinking at home, and looked at changes in drinking frequency by drink category. Among people who drank one or more days a week, beer came top, followed by malt-free and low-malt beer, then chuhai (Figure 4). On the other hand, looking at the differences in changes compared with before February 2020, low-alcohol and non-alcoholic beer saw double-digit increases (Figure 5). This is evidence of growth in the low-alcohol and non-alcoholic beer categories.

Looking at frequency of drinking at least once a week by beer category, 12.1% of them drank premium beer, about two-thirds of regular beer consumption (Figure 6). Furthermore, looking at the percentages for increased drinking frequency compared to before February 2020 by beer category, premium beer scored the highest at 14.8% (Figure 7). Regular beer, the most commonly consumed beer category, showed the lowest increase in frequency of consumption, while premium, malt-free, and low-malt beer showed higher increases.

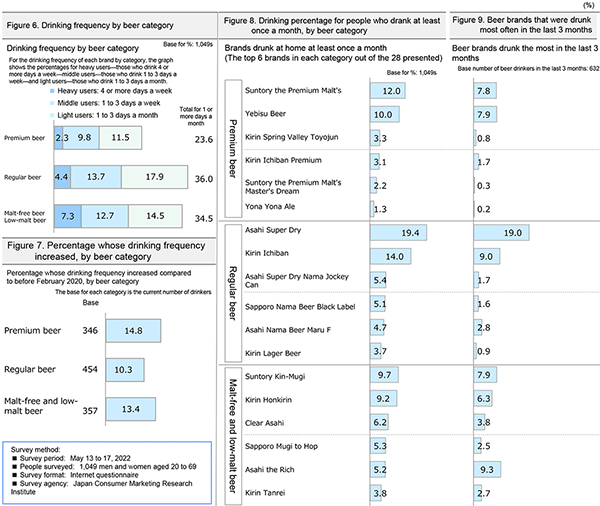

Next, looking at the percentages for drinking at home at least once a month by brand, among the 28 listed brands, Asahi Super Dry had the highest rate at approximately 20%, followed by Kirin Ichiban (Figure 8). The premium beer Suntory the Premium Malt's came third, and Yebisu Beer fourth. Premium beers had the next highest drinking percentages after the two highest-scoring regular beers. Although they did not score as high as Asahi Nama Beer Maru F, which is said to have been a big hit last year, the premium beers introduced by each company came close to it despite the high price range, showing presence of premium beers in the beer market.

Also, among the brands that were drunk the most often in the last 3 months, about 20% of people who drank beer in that period answered "Asahi Super Dry," giving it the highest score (Figure 9). This shows how strong Asahi Super Dry's base is.

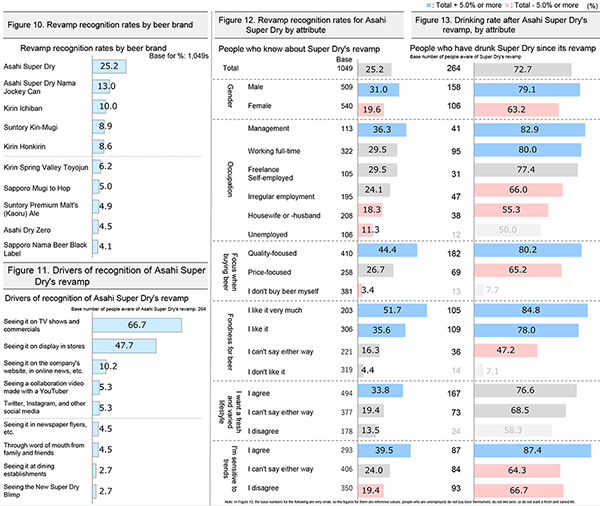

Looking at the awareness rates for recent beer revamps, Asahi Super Dry--which was revamped this February--had the highest score (Figure 10), with 1 out of 4 people aware of the revamp, including those who do not drink beer. TV shows, commercials, stores displays were the highest-scoring drivers of revamp awareness (Figure 11). The findings show that advertising and sales floor measures contribute greatly to awareness.

Next, looking at the drinking rates after Asahi Super Dry's revamp, the yield from recognition of it to drinking it among people recognize of the revamp is very high at 72.7%. This is about 18% of all respondents, including those who do not drink beer (Figures 12 and 13).

In addition, looking at the revamp recognition and post-revamp drinking rates for Asahi Super Dry by attribute, large differences can be seen based on gender and occupation. Awareness and drinking rates were high among men and people with managerial occupations. In addition, awareness and drinking rates were high among people who like beer, ones who are sensitive to trends, and ones who want a fresh and varied lifestyle. The findings show that 3 months after their revamped versions went on sale, what had initially been introductory segment beers were now being drunk as high-interest segment beers that were driving demand.

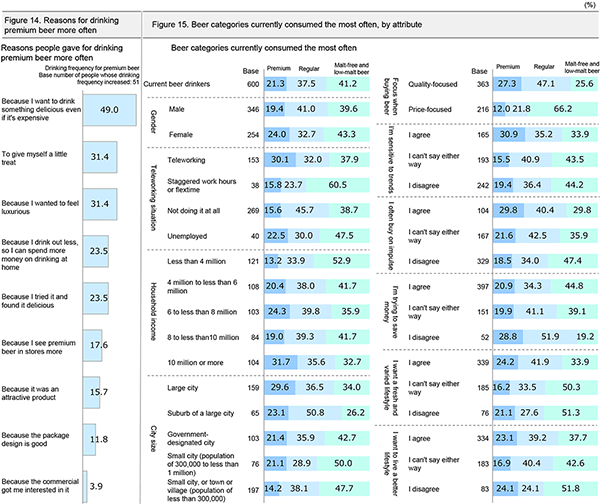

On the second page, the findings confirmed that people were drinking premium beer more often. Looking at the reasons, the most common one was "Because I want to drink something delicious even if it's expensive," accounting for about half of all respondents. This was followed by "To give myself a little treat" and "Because I wanted to feel luxurious" (Figure 14).

Looking at the beer categories currently consumed the most by various attributes, we can see differences in demand for premium beer between segments (Figure 15). In particular, there were large differences depending on basic attributes such as gender, teleworking situation, annual household income, and city size. Premium beer was mainly consumed by people who telework, have a high income, live in a large city, focus on quality when buying beer, or are sensitive to trends. The findings show that the demand for premium beer--the category companies are working on launching new products in--lies in the segments that are highly interested in beer. On the other hand, malt-free and low-malt beer were mainly consumed by people who have a low income, live in smaller cities, or want to save money.

As we have seen thus far, premium, malt-free, and low-malt beer are showing presence in the beer market, and the conventional structure centered on regular beer could increasingly split into an upper and lower price range.

Translating articles

- 6.9 Trillion Yen Market Created By Women― Will Afternoon Tea save the luxury hotels in the Tokyo Metropolitan Area

- Frozen Foods' Benefits Are Expanding, and Child-raising Women Are Driving Demand

おすすめ新着記事

成長市場を探せ 8年連続プラスのスナック菓子、インバウンドも貢献

スナック菓子市場の拡大が止まらない。小売り金額は8年連続プラス、2023年は2桁、24年も2桁に迫る成長で、6,000億円も射程圏内だ。

消費者調査データ シャンプー 首位は「パンテーン」、迫る「ラックス」、再購入意向には高機能ブランド並ぶ

高機能化の流れが続くシャンプー市場。調査結果からは、認知や直近購入などでは「パンテーン」が首位を獲得したが、再購入意向では個性的なブランドが上位に並んだ。

消費者調査データ 印象に残ったもの 働く女性首相誕生の2025年は、万博に沸き、熊と米に揺れた

2025年は女性首相誕生や万博などに沸いたが、、米価高騰、熊被害、異常気象などに揺れた。消費者の印象にのこったのはどんなものだったか。

![戦略家のための知的羅針盤[エム・ネクスト]product by 松田 久一](/img/mnext-sub-title.png)